Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Fixed Overhead Budget Variance

This variance provides insights into how effectively a company is managing its fixed overhead expenses in the context of its operations and production activities. An unfavorable fixed overhead budget variance results when the actual amount spent on fixed manufacturing overhead costs exceeds the budgeted amount. The fixed overhead budget variance is also known as the what’s the difference between salary vs wage employees. The fixed overhead spending variance is the difference between the actual fixed overhead expense incurred and the budgeted fixed overhead expense.

9: Fixed Manufacturing Overhead Variance Analysis

Instead, Jerry’s mustreview the detail of actual and budgeted costs to determine why thefavorable variance occurred. For example, factory rent, supervisorsalaries, or factory insurance may have been lower thananticipated. Further investigation of detailed costs is necessaryto determine the exact cause of the fixed overhead spendingvariance. It is important to start by noting that fixed overhead in themaster budget is the same as fixed overhead in the flexible budgetbecause, by definition, fixed costs do not change with changes inunits produced. Thus budgeted fixed overhead costs of $140,280shown in Figure 10.12 will remain the same even though Jerry’sactually produced 210,000 units instead of the master budgetexpectation of 200,400 units.

Formulas to Calculate Overhead Variances

Notice that the efficiencyvariance is not applicable to the fixed overhead varianceanalysis. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Estimate the total number of standard direct labor hours that are needed to manufacture your products during 2023.

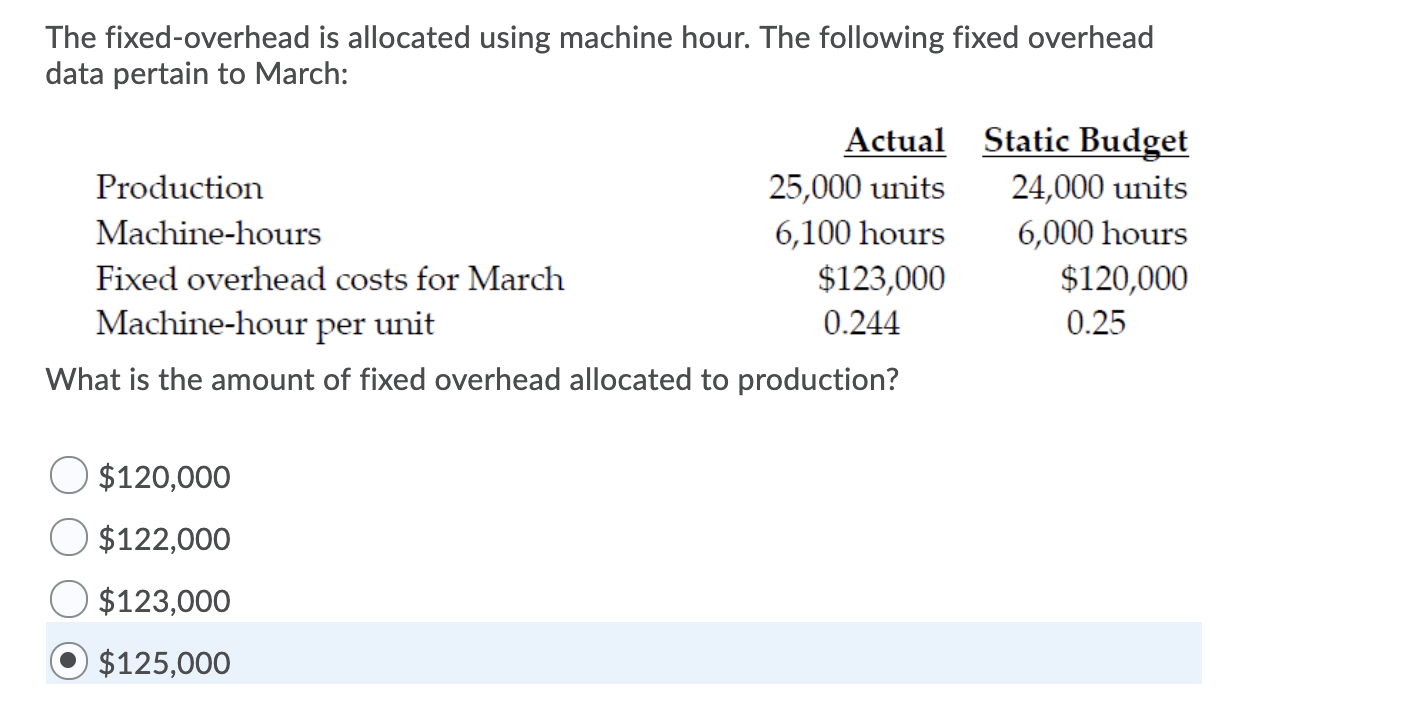

It is one of the two parts of fixed overhead total variance; the other is fixed overhead volume variance. Total overhead cost variance can be subdivided into budget or spending variance and efficiency variance. Variable overhead spending variance is essentially the difference between the actual cost of variable production overheads versus what they should have cost given the output during a period. When the actual output exceeds the standard output, it is known as over-recovery of fixed overheads.

Analysis

Let’s say you expected to pay $20,000 in fixed overhead, then if you actually paid $22,000,you would have an unfavorable spending variance of $2,000. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead reduction. Looking at Connie’s Candies, the following table shows the variable overhead rate at each of the production capacity levels.

- This means there was not enough good output to absorb the budgeted amount of fixed manufacturing overhead.

- In such a case, the company incurs an entirely new expense that the production department didn’t anticipate.

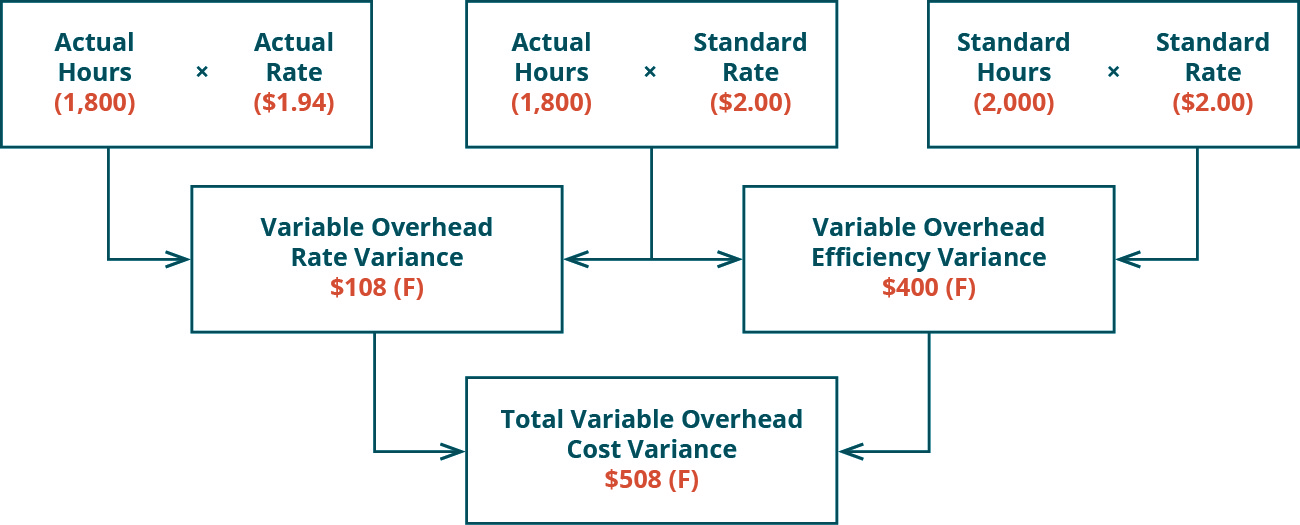

- The total variable overhead cost variance is also found by combining the variable overhead rate variance and the variable overhead efficiency variance.

This is a portion of volume variance that arises due to high or low working capacity. It is influenced by idle time, machine breakdown, power failure, strikes or lockouts, or shortages of materials and labor. One is that you spent more or less in fixed overhead than you expected, and two is thatyou created more units or fewer units than you expected to. If the outcome is favorable (a negative outcome occurs in the calculation), this means the company was more efficient than what it had anticipated for variable overhead. If the outcome is unfavorable (a positive outcome occurs in the calculation), this means the company was less efficient than what it had anticipated for variable overhead. Variance analysis is the process of identifying and quantifying the differences between actual and budgeted or standard performance measures, such as costs, revenues, or quantities.

Standard fixed overhead applied to actual production is the fixed overhead cost that is applied to the actual production volume using the standard fixed overhead rate. Fixed manufacturing overhead costs remain the same in total even though the production volume increased by a modest amount. For example, the property tax on a large manufacturing facility might be $50,000 per year and it arrives as one tax bill in December.

Leave a Reply